Process Flow

Before going into details about how to use the model and its features, it will be a good idea to understand the general logic flow of the model. Basically the model works with this simple logic:

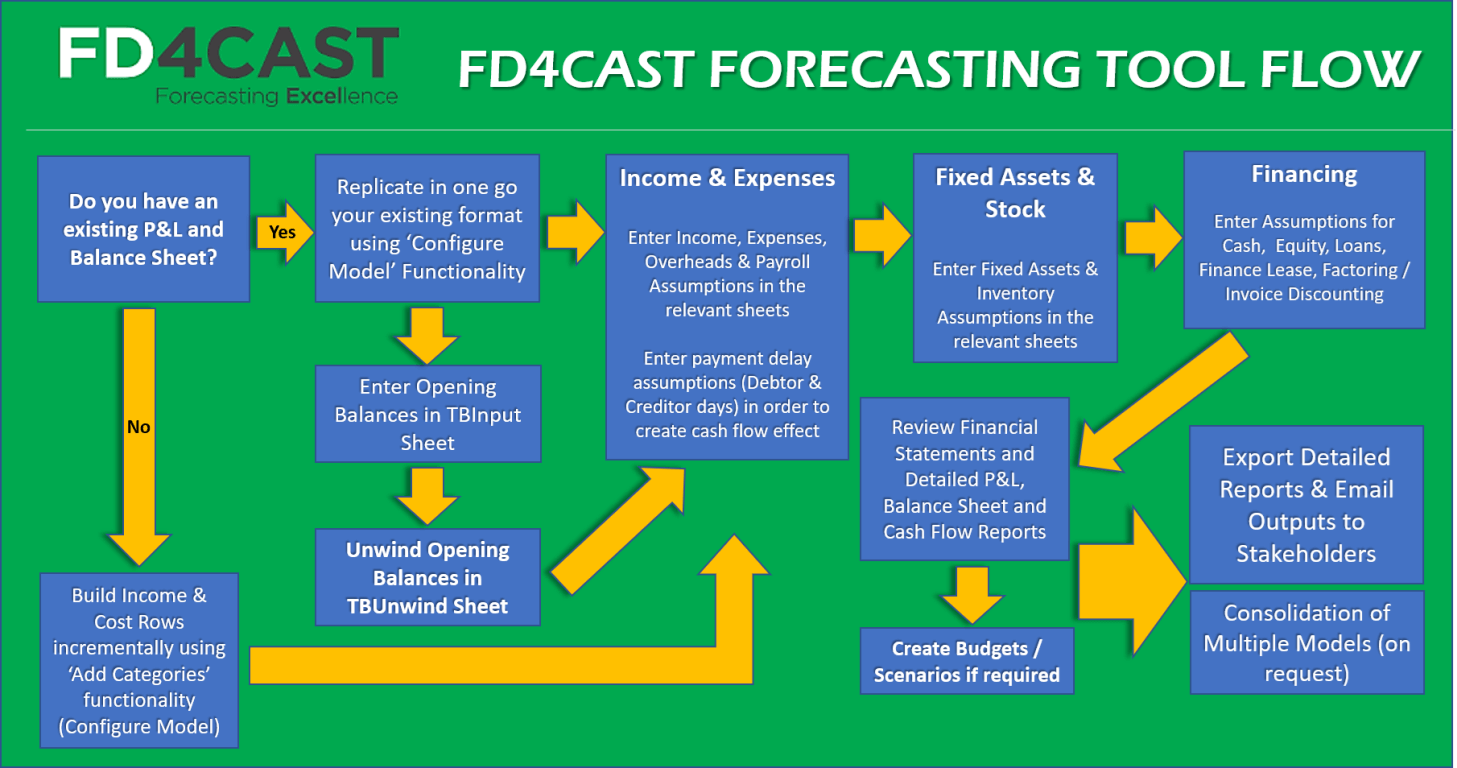

Set your initial Balance > Input Revenues & Expenses > Define your Assets > Define how do you Finance your company > Take the Output Reports

The model may be configured depending on many factors such as your company type, services/products you offer, financing methods and so on. Below you will see more detailed process flow of the FD4Cast tool:

- It starts with deciding whether you have an existing balance sheet or not. If you have an existing company with past financial figures then you should first set up your Opening Balance Sheet and start unwinding trial balance. If you are a start-up or a new company without historical finances, then you can skip setting up opening balances and directly go to configuring your model’s categories.

- Then comes the Income and Expenses stage. At this stage, you start to define your revenue items, expenses, overheads and payroll. This is the main skeleton of your model.

- After setting up the income and expenses, you will define your assets as shown on the flow. This is closely followed by setting up the financing parameters such as loans, leasing decisions, investments and so on. These together will comprise the balance sheet.

- Once you have input the figures in the previous stages, your financial reports will be ready. Profit and Loss, Balance Sheet, Cash Flow reports will be ready automatically according to the parameters defined. At this stage, you can also run scenarios and consolidate your reports to create some custom outputs for stakeholders.

After completing the flow you may then start to fine-tune your model. When you review the outputs you may want to go back and change some parameters to come up with more reasonable scenarios or reflect foreseen changes.